STAKEHOLDER STRATEGIES TO COMBAT ILLICIT TRADE

Peggy E. Chaudhry

Villanova School of Business, Villanova University

John Reiners

Managing Editor Thought Leadership, EMEA, Oxford Economics

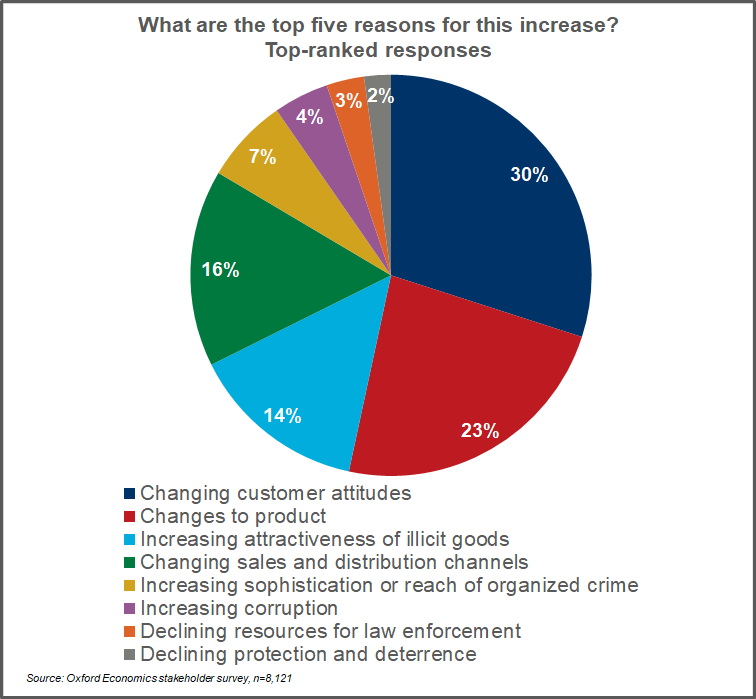

Our analysis[1] of 8,121 stakeholders (i.e., specifically business executives, policy officials and law enforcement officers) and 37,300 consumers fielded across 37 European countries[2] provides a comprehensive picture of changing stakeholder perspectives and consumer attitudes and behaviors regarding illicit trade. We explored stakeholders’ views of consumers’ motivations and purchasing behaviors, to see if they are aligned with those of consumers. As Figure 1 highlights, stakeholders perceive changing customer attitudes as the most important driver of illicit trade (30%), followed by changes in products (23%) and sales and distribution channels (16%).

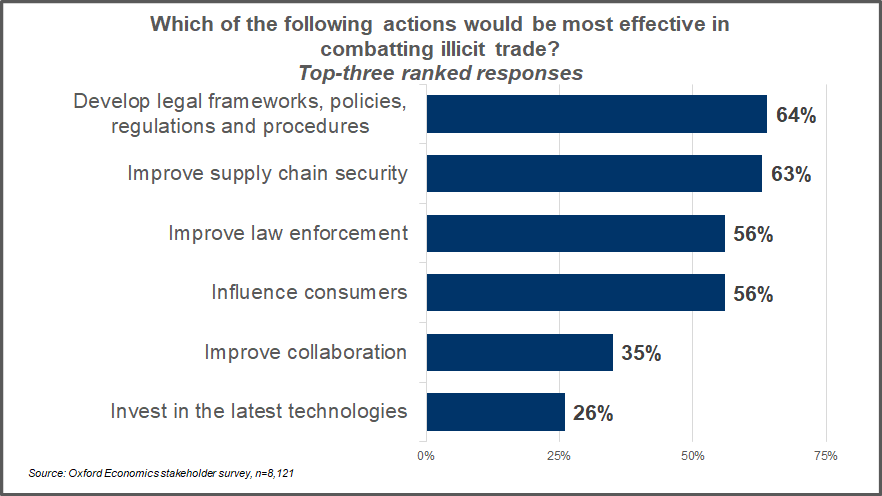

Stakeholders know there is no simple solution and that illicit trade must be targeted from multiple angles (See Figure 2). These include, developing better legal and policy frameworks, tightening supply chains, improving enforcement at the border and influencing customer behavior. Effective collaboration between the multiple agencies involved in combatting illicit trade and deployment of technologies will be needed to support initiatives in all these areas.

Influencing Consumers — Stick or Carrot?

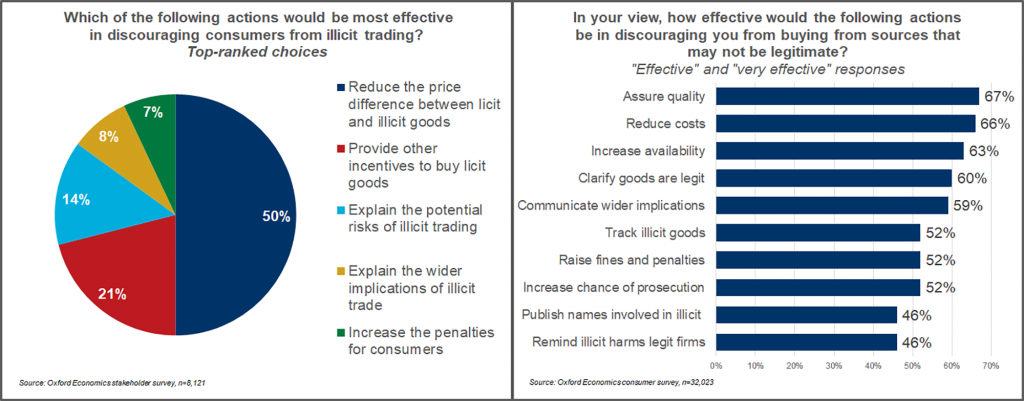

Stakeholders believe that reducing the price difference between licit and illicit goods is by far the most effective action to influence consumers (See Figure 3). Significant price changes may be difficult to execute in a competitive market, or where different rates of excise duty create large cross-border price differences. Notably this finding contrasts with the views of consumers, who attach similar importance to quality assurance and guaranteeing that products are legitimate.

There is a clear disjunction between stakeholders and consumers’ perspectives, such as:

- Providing positive incentives to buy licit goods is seen as most effective by only 21% of stakeholders, yet initiatives to assure quality (67%) and increase availability (66%) are seen by consumers as among the most effective.

- Explaining the potential risks and wider implications of illicit trade is top priority for 14% and 8% of stakeholders, respectively. Consumers, however, appear receptive to authentication by clarifying product is legitimate (60%) and information about the wider implications of illicit trade (59%).

Stakeholders are more aligned with consumers when it comes to penalties for engaging in illicit trade. Only 7% of stakeholders highlighted increasing the chances of prosecution and penalties as their top priority. More than half of business executives (55%) fear that overzealous efforts to combat illicit trade would generate negative publicity.

Securing the Supply Chain

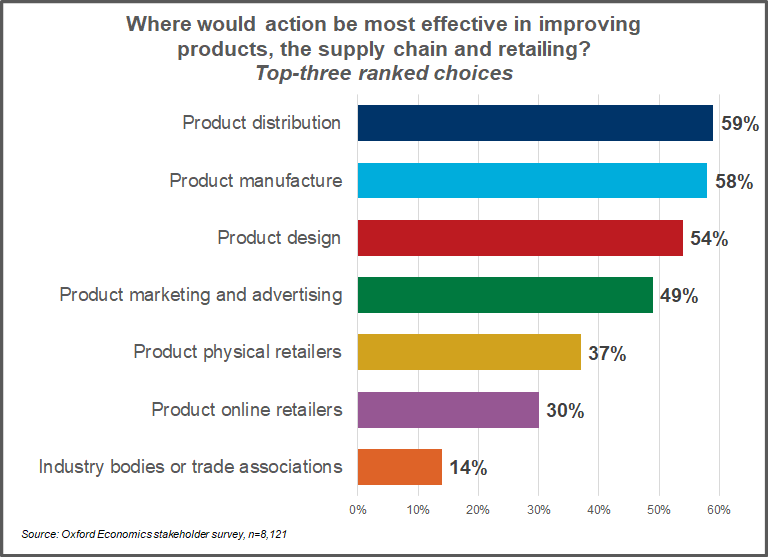

Stakeholders identified actions in product design, manufacture and distribution as key to reducing illicit trade (see Figure 4). At the design stage, cigarettes and medicines suppliers are putting identification markers on packets, such as e-fingerprints. The European Anti-Fraud Office’s (OLAF) strategy to combat illicit tobacco sales includes controlling inputs to the manufacturing process, such as the acetate tow used in filters. Only 14% of stakeholders overall prioritize industry bodies and trade associations to play a leading role in combatting illicit trade.

Updating and Harmonizing Legal and Policy Frameworks

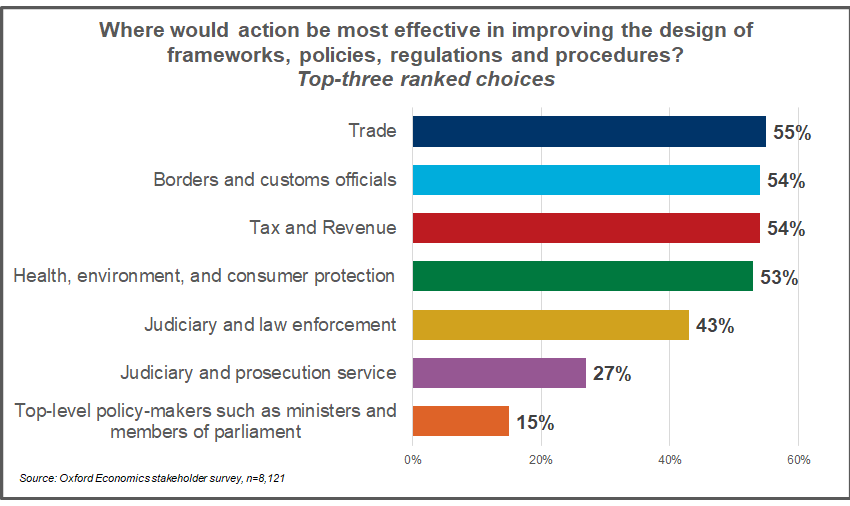

When asked where work was most needed in policy design, stakeholders highlight trade (e.g., tracking and reporting), borders and customs, tax and revenue, followed by health, the environment, and consumer protection. These scored higher than judiciary, law enforcement and prosecution enforcement. Differences in legislation across so many countries can inhibit information exchange. Penalties for IP crime and counterfeiting vary considerably across Europe. In many places it is not considered a serious crime, and prosecution rates are low. Figure 5 demonstrates the breadth of policy work needed and indicates that updating sanctions for illicit trade is a lower priority for stakeholders.

Improving Enforcement

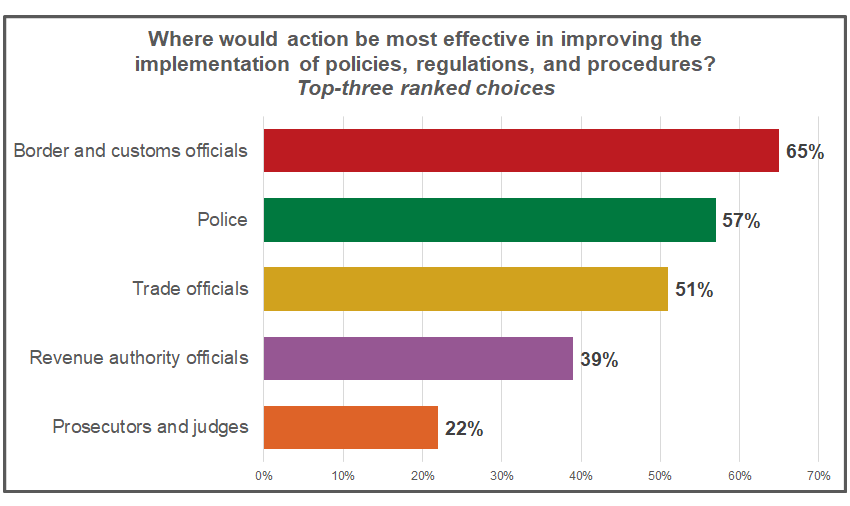

Less than 60% of law enforcement respondents said they had access to good information, effective systems, policies and procedures (58%). As a result, just over half (56%) report they have difficulty ensuring compliance with systems, policies and procedures. When asked to prioritize improvements in law enforcement, borders and customs came first, followed by police (see Figure 6). Improving prosecution and the judicial process are consistently considered far less important, and reflect the inconsistencies and known difficulties of securing convictions for illicit trading.

The EU has invested in improving the external border, largely in response to the immigration crisis. Many customs officers are collaborating with freight forwarders, parcel delivery companies and distribution depots to deal with the large volume of small packages. Some border forces are investing in scanning equipment or collecting better information and sharing it with others to strengthen intelligence. However, it is a challenge to keep up with changing routes and cunning disguises of illicit supplies. Nearly 60% of stakeholders agree that law enforcement resources have not kept pace with shifts in global trade, both at the international border and in-country.

Making Collaboration Work

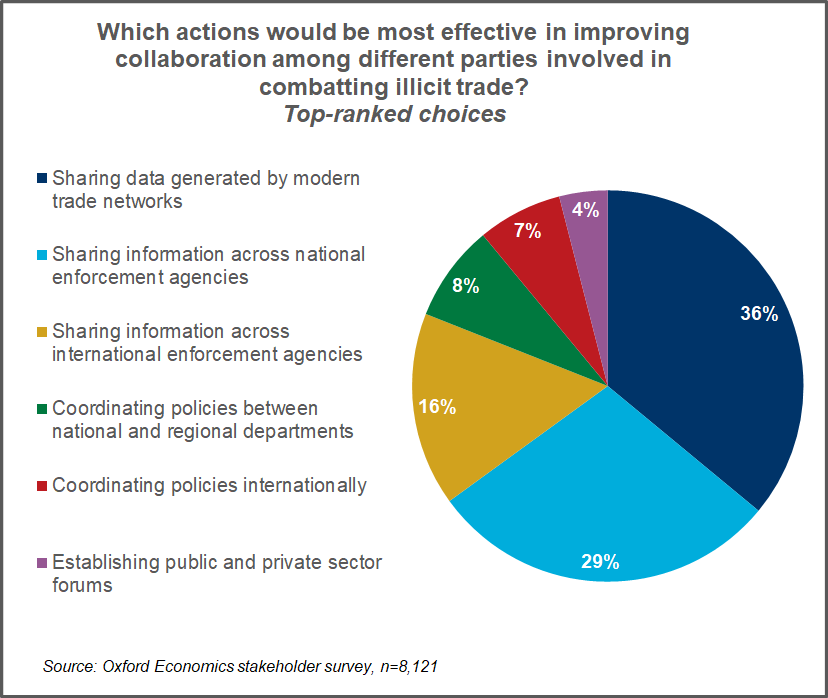

Figure 7 clearly illustrates a preference for collaborating on data and intelligence rather than policies and procedures. Key findings are:

- Collaborating by sharing data to build intelligence on the patterns of trade is clearly the most important sphere of cooperation and cited by over 50% of stakeholders in some counties, like Luxemburg (53%) and Malta (51%).

- Sharing data among national agencies, though second overall, is the highest priority for several countries, including Austria, Belgium, Belarus, Germany, Greece, the Netherlands, Portugal and Spain.

- Cooperating with national agencies scores higher than international collaboration, for both data-sharing and co-ordination of policies and operations.

- Leading agencies designed to reduce illicit trade, such as Interpol, Europol, the World Customs Organization and OECD Taskforce on Illicit Trade continue to work with stakeholders across Europe. But, only 7% of the stakeholders rated international cooperation as valuable.

- Establishing public and private sector forums is the least popular, the top priority for only 4% of respondents.

Diverging Views of Technology

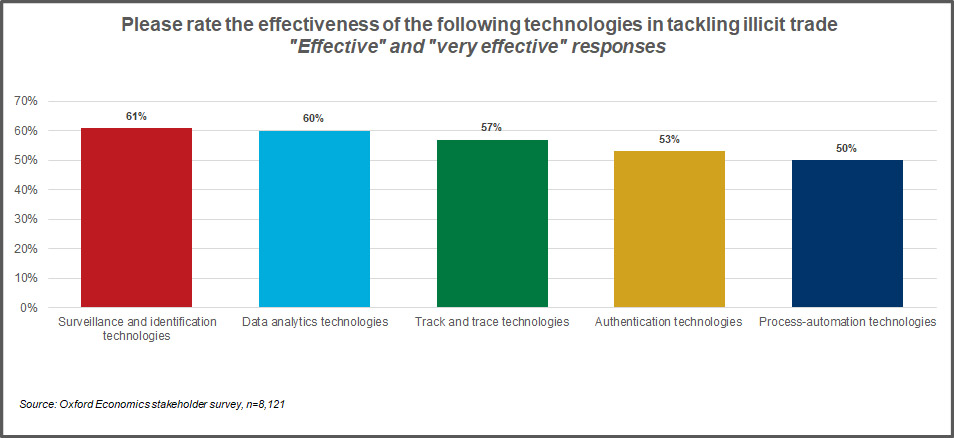

Modern technologies promise significant advances in fighting illicit trade, but they can be expensive to implement and upgrade. We asked stakeholders to assess the value of five technologies in combatting illicit trade, and none were particularly enthusiastically endorsed. The most popular — surveillance and identification technologies — are perceived as effective by only 61% of stakeholders.

Only 48% of business executives say they have access to good information on the extent and changing patterns of illicit trade (compared with 56% of policy officials and 58% of law enforcement officers). The cigarette industry has invested heavily in collecting data through empty pack surveys, but other products still lack enough data to analyze patterns of illicit trade.

Still, our research suggests that technology will provide better results at lowered cost, in several areas:

- Scanning equipment is expected to improve rapidly.

- Authentication technologies such as blockchain can have a material impact on illicit trade.

- Data collection and analysis, using Big Data and analytical tools to recommend actions based on risk assessments. Modern trade networks and supply chains often leave an extensive digital trail that can help to highlight patterns in illicit trade. Our survey shows stakeholders are shifting their focus from collecting data to data analysis.

Tackling Illicit Trade Persists

To combat the changing patterns of illicit trade, stakeholders — policy officials, law enforcement and business executives — need to update their approaches on several fronts. Policy, regulatory and legal frameworks need to keep pace by, for example, responding to the growth of e-commerce. Supply chains need to be secured from end to end, recognizing the new roles of many intermediaries. Law enforcement at the border and in-country needs to be strengthened, making best use of the latest technologies. The cross-border nature of illicit trading presents challenges in Europe, with a need to co-ordinate national approaches across the European Union as well as securing borders with the wider world. Stakeholders seem aware of the shifting nature of illicit trade and are refocusing their priorities. Implementation, however, is patchy, with many stakeholders recognizing that there is much more to be done. It is difficult securing limited resources, particularly when competing against other initiatives and causes.

[1] This research was carried out by the independent consultancy Oxford Economics and financed by PMI IMPACT through a global grant by Philip Morris International that supports research on illicit trade and crimes across industry sectors. [1] Two surveys were fielded in parallel from Dec 17, 2017 to Jan 18, 2018 across 37 European countries, a survey of 37,370 consumers and a survey of stakeholders working to combat illicit trade (5,562 business executives, 1,146 policy officials and 1,413 law enforcement officers).

THE BRAND PROTECTION PROFESSIONAL | JUNE 2020 | VOLUME 5 NUMBER 2

COPYRIGHT 2020 MICHIGAN STATE UNIVERSITY BOARD OF TRUSTEES